Some good mentions on Inside Job (2010).

Depicted at: Len Sassaman tribute.

Won 2022 Nobel Prize.

He beats the The European Union is a failure drum pretty well.

- www.youtube.com/watch?v=iVxaTC7Qp44 The Global Minotaur: The Crash of 2008 and the Euro-Zone Crisis in Historical Perspective (2011)

Political Economy: The Social Sciences Red Pill by Yanis Varoufakis (2016)

Source. - youtu.be/vNhkYXhYSSs?t=368 proposes that there is something missing from utility maximization, citing a lotus-Eater Machine idea

What a complete loss of ones life post computers! So many intelligent and motivated people completely wasting their life and energy. Finance is a cancer of society.

You need separate accounts for different countries: money.stackexchange.com/questions/73361/two-banks-in-two-countries-is-it-possible-to-have-a-unique-paypal-account it's a pain.

This is a good company, first they truly helped reduce international transfer fees. They they continued to morph into a decent challenger bank.

Brick and mortar banks were way way behind in that regard!

E.g. October 2023, Wise was doing 4.87% interest after fees, while Barclay's best option was 1.16% above 5k pounds on the Rainy Day Saver (5% below). Ridiculous!

Update: On November 2023 unfortunately they more than doubled their fees from 0.19% to 0.46%:

but it still was a good option to keep cash in.

- the American stock market gives 10% / year, which is about 2x over 10 years. It has been the sure-fire best investment on a 10 year horizon for many decades, and should serve as your benchmark.

- risky diversified investments (e.g. ETFs that track a market index) are basically the best investment if you can keep your money in them in the long term (10 years)

- risky investments can gown down for a while, and you cannot take your money out then. This effectively means risk is a form of illiquidity

- investment funds have taxes, which eat into your profit. The best investments are dumb index tracking investments (like an ETF that tracks the stock market) that are simply brainless to manage, and therefore have lowest taxes. No fund has managed to beat the market long term essentially.

- when you are young, ideally you should invest everything into riskier higher yielding assets like stock. And as you get older, you should move part of it to less risky (and therefore more liquid, but lower yielding) assets like bondsThe desire to buy a house however complicates this for many people.

This is a good concept. For the ammount most people save, having a simple and easy to apply investment thesis is the best way to go.

A person who gives financial advice, notably personal finance advice. Some of them are questinable guru-like beings, and many are on YouTube.

The financial industry does not serve society nowhere near its magnitude (London of course being the epitome of that). It serves only itself. It just grows without bound.

- www.theatlantic.com/technology/archive/2011/05/on-the-floor-laughing-traders-are-having-a-new-kind-of-fun/238570/ On the Floor Laughing: Traders Are Having a New Kind of Fun (2011) by James Somers describes trading as a kind of game.

Why I chose quant trading to retire early by Lit Nomad

. Source. Ciro Santilli was not sure under which section classify this video. It is worthwhile despite the title- youtu.be/exPt6mVgpfY?t=123 describes how at Lockheed Martin they were playing the "we are doing it for national defense, not for money card" on employees. Ciro Santilli came to understand and despise similar hypocrisy via Ciro's everyone gets a raise story

Courts of law should decide if your money is legal or not. Not private entities such as banks. This is actually a case for cryptocurrencies and central bank digital currencies.

Ciro Santilli had a fun mini-case of this with his Barclays account frozen for a few days in 2024 in the UK after receiving a large anonymous cryptocurrency donatio: Barclays regulation.

Good documentary about it: Nick Leeson and the Fall of the House of Barings by Adam Curtis (1996).

One is reminded of Annie Dookhan.

High Frequency Trading by WEED e.V. (2014)

Source. Ciro Santilli once talked to a man who had been working on high-frequency trading for the last six years.

He was quite nice.

Ciro asked him in what way did he feel his job contributed to the benefit of society.

He replied that it didn't contribute at all. It was completely useless. More than that, it so completely useless, that it was even pure. A bit like advanced mathematics, but not even providing beauty for anybody outside of the company, since everything is a closely guarded trade secret, unlike mathematics which is normally published for the vanity recognition.

And so, Ciro was enlightened.

A great mind can work in the most useless branches of finance, without the desire to improve the world, nor make it worse. Not to compete, nor be afraid, nor anxious. A sand mandala.

The Men Who Stole the World by Benoît Bringer

. This timestamp contains a good explanation of how banks were knowingly reselling bad loans at incredible profits. It features Richard Bowen, previously from Citi Group compliance.Senior partners emergency meeting scene from Margin Call

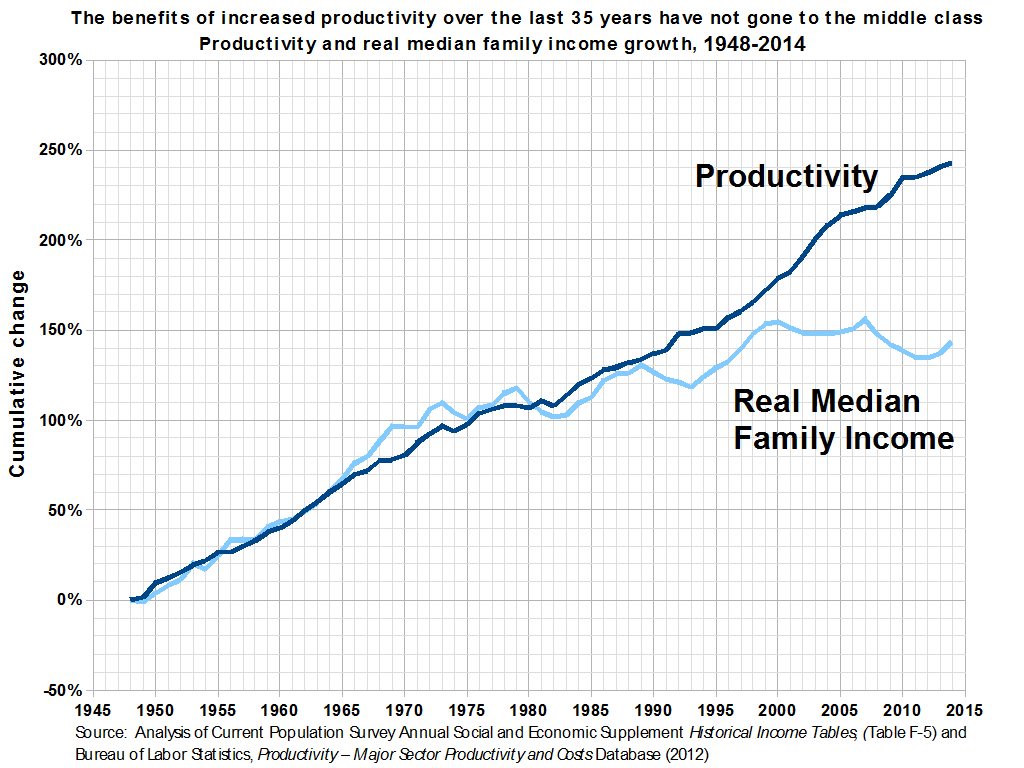

. Source. God, Jeremy Irons is destroying it!!! And all others too.To Ciro Santilli, a key observation is:Clearly the rich will be much, much more shielded by keeping large parts of their wealth in shares... from this point of view, it is insane to print money!!! Tax the rich instead...

The rich are more easily able to avoid the harm than poor and middle-class people [...] they are more likely to have large amounts of non-cash assets to shield themselves from inflation.

Ciro Santilli is extremely passionate about this issue, partly due to Ciro Santilli's self perceived compassionate personality.

One of Ciro's most direct experiences with social inequality is described at: São Remo, the favela next to USP.

We have to be careful not to make everyone poorer when trying to reduce inequality.

But as things stand as of 2020, increasing taxes on the very richest, and notably wealth tax, and investing it in free gifted education, seems like a safe bet to achieve any meaningful level of equal opportunity and meritocracy.

Ciro Santilli is against all affirmative action, except for one: giving amazing free eduction to the poor.

Notably, Ciro is against university entry quotas.

www.cbpp.org/wealth-concentration-has-been-rising-toward-early-20th-century-levels-2 shows historical for top 1% and 0.5% from 1920 to 2010.

TODO why is it so hard to find a proper cumulative distribution function-like curve? OMG. This appears to be also called a Lorenz curve.

Wealth Inequality in America by politizane

. Source. How the Stock Market Works (1952)

Source. TODO source.This is some fishy, fishy business.

- Dilbert

- Severance 2022

- tvtropes.org/pmwiki/pmwiki.php/Main/SoulCrushingDeskJob

- en.wikipedia.org/wiki/Bullshit_Jobs

- Falling Down 1993

Articles by others on the same topic

There are currently no matching articles.