Apple Music is a subscription-based music streaming service developed by Apple Inc. It was launched in June 2015 and allows users to access a vast library of songs, albums, playlists, and music videos. Subscribers can stream music on-demand, create and share playlists, and enjoy personalized music recommendations based on their listening habits. Key features of Apple Music include: 1. **Music Library**: Access to over 90 million songs and a variety of genres.

The term "Preferred Executable Format" doesn't refer to a widely recognized or standardized concept in computing or software development. However, it may pertain to the preferred file format for executing programs on a specific operating system or environment. Here are a couple of contexts where similar phrases might be relevant: 1. **Executable File Formats**: Different operating systems have their preferred formats for executable files. For example: - Windows typically uses `.exe` and `.dll` file formats.

Here is a list of some notable programming languages organized by their creation date: 1. **Assembly Language (1940s)** - The earliest low-level programming languages that use symbolic names instead of numeric opcodes. 2. **FORTRAN (1957)** - The first high-level programming language designed for scientific and engineering calculations. 3. **LISP (1958)** - A list processing language, notable for its use in artificial intelligence and symbolic computation.

Classic Mac OS is the original operating system developed by Apple Inc. for Macintosh computers, starting from its introduction in 1984 until it was succeeded by macOS (formerly known as Mac OS X) in 2001. The Classic Mac OS is notable for its graphical user interface (GUI), which was one of the first to be widely adopted, allowing users to interact with their computers using a mouse and visual icons rather than text-based commands.

Internet Config is a legacy configuration management tool developed by Apple for Mac OS that was primarily used in the late 1990s and early 2000s. It allowed users to manage internet preferences and settings for various applications such as web browsers, email clients, and FTP applications. The tool facilitated the management of essential internet settings like proxy configurations, email settings, and more, providing a centralized interface for users to customize their internet connectivity options.

The Mac OS nanokernel is a core component of the operating system architecture used in Apple's macOS and is a descendant of the Mach microkernel. The term "nanokernel" often refers to a lightweight kernel that handles the most fundamental tasks required by the operating system while relying on other components, like device drivers and higher-level services, to manage additional functionality.

The term "Network Browser" can refer to several different concepts, depending on the context. Here are a few common interpretations: 1. **File Sharing and Network Browsing**: In the context of computer networks, a network browser allows users to view and interact with shared resources on a local area network (LAN). This could include accessing shared folders, files, printers, and other devices.

A distributed operating system (DOS) is a type of operating system that manages a collection of independent computers and makes them appear to the users as a single coherent system. The key features of a distributed operating system include: 1. **Transparency**: It aims to hide the complexities and variations of the underlying hardware and network from the users and applications. This includes location transparency, migration transparency, replication transparency, and failure transparency.

Dylan is a multi-paradigm programming language designed for high performance and for building software systems. Its history dates back to the early 1990s. 1. **Origins**: Dylan was developed in the early 1990s by a group at Apple Computer, including key figures such as James Anderson, who had previously been involved with the Object-Oriented programming community.

R-Ladies is a global organization and community aimed at promoting gender diversity in the R programming language and the broader data science and statistics fields. Founded in 2016, R-Ladies seeks to provide a supportive environment for individuals who identify as women and to encourage their participation and visibility in the R community. The group organizes meetups, workshops, and events to share knowledge, provide networking opportunities, and create a collaborative space for learning and sharing experiences related to R and data science.

A monolithic application is a software architecture pattern where all the components of the application are combined into a single, unified program. This includes the user interface, business logic, and data access layers bundled together into a single codebase and typically deployed as a single unit. ### Characteristics of Monolithic Applications: 1. **Single Codebase**: The entire application resides in one codebase, which makes it easier to manage version control but can complicate collaborative development over time.

X/Open, now part of the Open Group, was an organization established in the 1980s to establish standards for interoperability in computing, particularly among different UNIX operating systems. The primary goal of X/Open was to create a common set of specifications to facilitate the development of applications that could run across different Unix systems and related environments.

Ada Developers Academy is a non-profit educational organization based in the United States that focuses on providing women and gender-expansive individuals with training and resources for a career in software development. Named after Ada Lovelace, who is often regarded as one of the first computer programmers, the academy aims to bridge the gap in the tech industry by fostering diversity and inclusion.

Girls Make Games is a non-profit organization dedicated to empowering young girls and women through gaming and game development. Founded in 2014, the organization aims to inspire and educate girls by providing them with the skills and tools needed to pursue careers in the gaming and tech industries. Girls Make Games conducts various initiatives, including summer camps, workshops, and game design competitions, where participants can learn about game design, programming, storytelling, and more.

Mariana Costa Checa is a notable entrepreneur and social impact advocate from Peru. She is best known for her work in the tech and education sectors, particularly for co-founding and leading organizations that focus on empowering young people through digital skills training and education. One of her significant initiatives is Laboratoria, a social enterprise that trains women for careers in technology, aiming to close the gender gap in the tech industry in Latin America.

The term "Petrie multiplier" can refer to a concept in mathematical literature or specific applications in certain fields, like fractal geometry or theoretical physics, but it is not a widely recognized term in mainstream mathematics or scientific literature.

A pressure ridge in the context of ice refers to a prominent, often jagged, formation that occurs in sea ice as a result of competing forces, usually wind and ocean currents. These forces can cause the ice to push against itself, leading to the buckling and stacking of ice layers. Pressure ridges can vary in height and width and are often found in polar regions where sea ice is prevalent.

James Peck is a notable civil servant in the United Kingdom, recognized for his role in public administration and his contributions to various governmental functions. If you're referring to a specific period or aspect of his career, additional details would help in providing a more focused answer. Peck's work generally involves areas such as policy development, public governance, or other civil service responsibilities.

"Older Peron" does not appear to correspond to a widely recognized term, concept, or entity in popular discourse or academic literature up to my last training cut-off in October 2021. It could potentially be a misspelling or a specific reference to something that emerged after that date.

Hasbro Family Game Night is a series of video games published by Hasbro, featuring board games and classic games that are adapted for digital play. Launched initially for consoles like the PlayStation 3 and Xbox 360, the series allows families and friends to enjoy a variety of popular games in a virtual format. The collection typically includes adaptations of well-known Hasbro properties such as "Monopoly," "Scrabble," "Battleship," and "Boggle," among others.

Pinned article: Introduction to the OurBigBook Project

Welcome to the OurBigBook Project! Our goal is to create the perfect publishing platform for STEM subjects, and get university-level students to write the best free STEM tutorials ever.

Everyone is welcome to create an account and play with the site: ourbigbook.com/go/register. We belive that students themselves can write amazing tutorials, but teachers are welcome too. You can write about anything you want, it doesn't have to be STEM or even educational. Silly test content is very welcome and you won't be penalized in any way. Just keep it legal!

Intro to OurBigBook

. Source. We have two killer features:

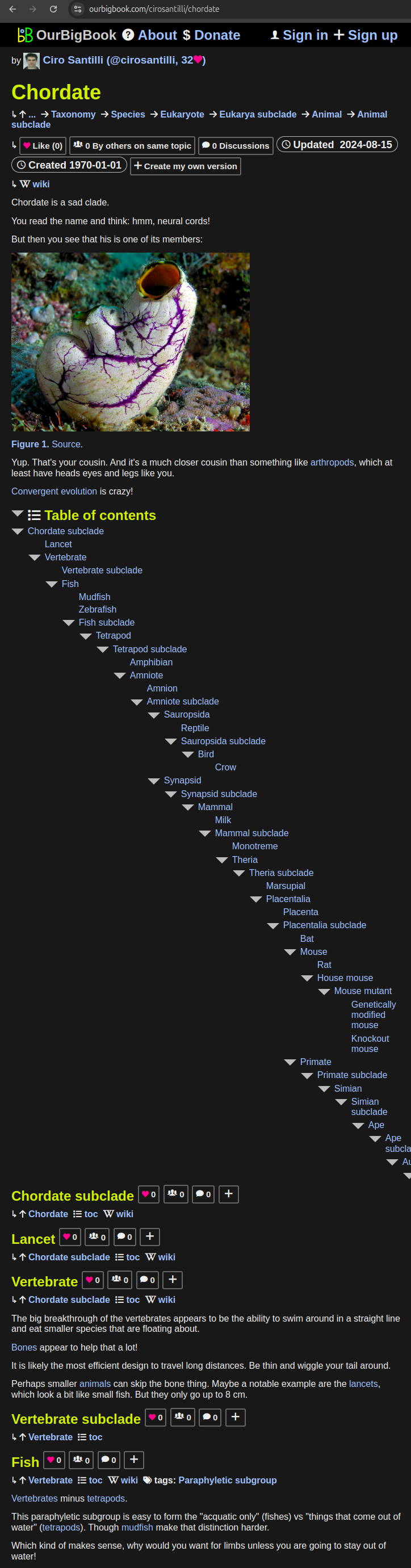

- topics: topics group articles by different users with the same title, e.g. here is the topic for the "Fundamental Theorem of Calculus" ourbigbook.com/go/topic/fundamental-theorem-of-calculusArticles of different users are sorted by upvote within each article page. This feature is a bit like:

- a Wikipedia where each user can have their own version of each article

- a Q&A website like Stack Overflow, where multiple people can give their views on a given topic, and the best ones are sorted by upvote. Except you don't need to wait for someone to ask first, and any topic goes, no matter how narrow or broad

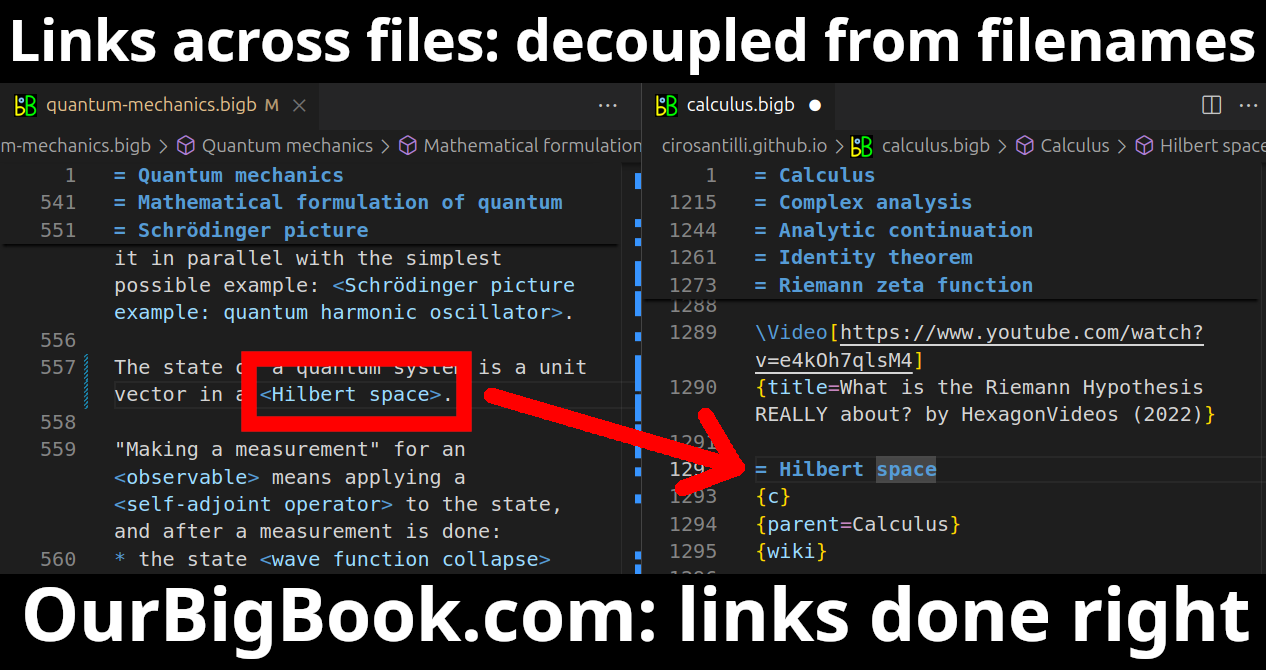

This feature makes it possible for readers to find better explanations of any topic created by other writers. And it allows writers to create an explanation in a place that readers might actually find it.Figure 1. Screenshot of the "Derivative" topic page. View it live at: ourbigbook.com/go/topic/derivativeVideo 2. OurBigBook Web topics demo. Source. - local editing: you can store all your personal knowledge base content locally in a plaintext markup format that can be edited locally and published either:This way you can be sure that even if OurBigBook.com were to go down one day (which we have no plans to do as it is quite cheap to host!), your content will still be perfectly readable as a static site.

- to OurBigBook.com to get awesome multi-user features like topics and likes

- as HTML files to a static website, which you can host yourself for free on many external providers like GitHub Pages, and remain in full control

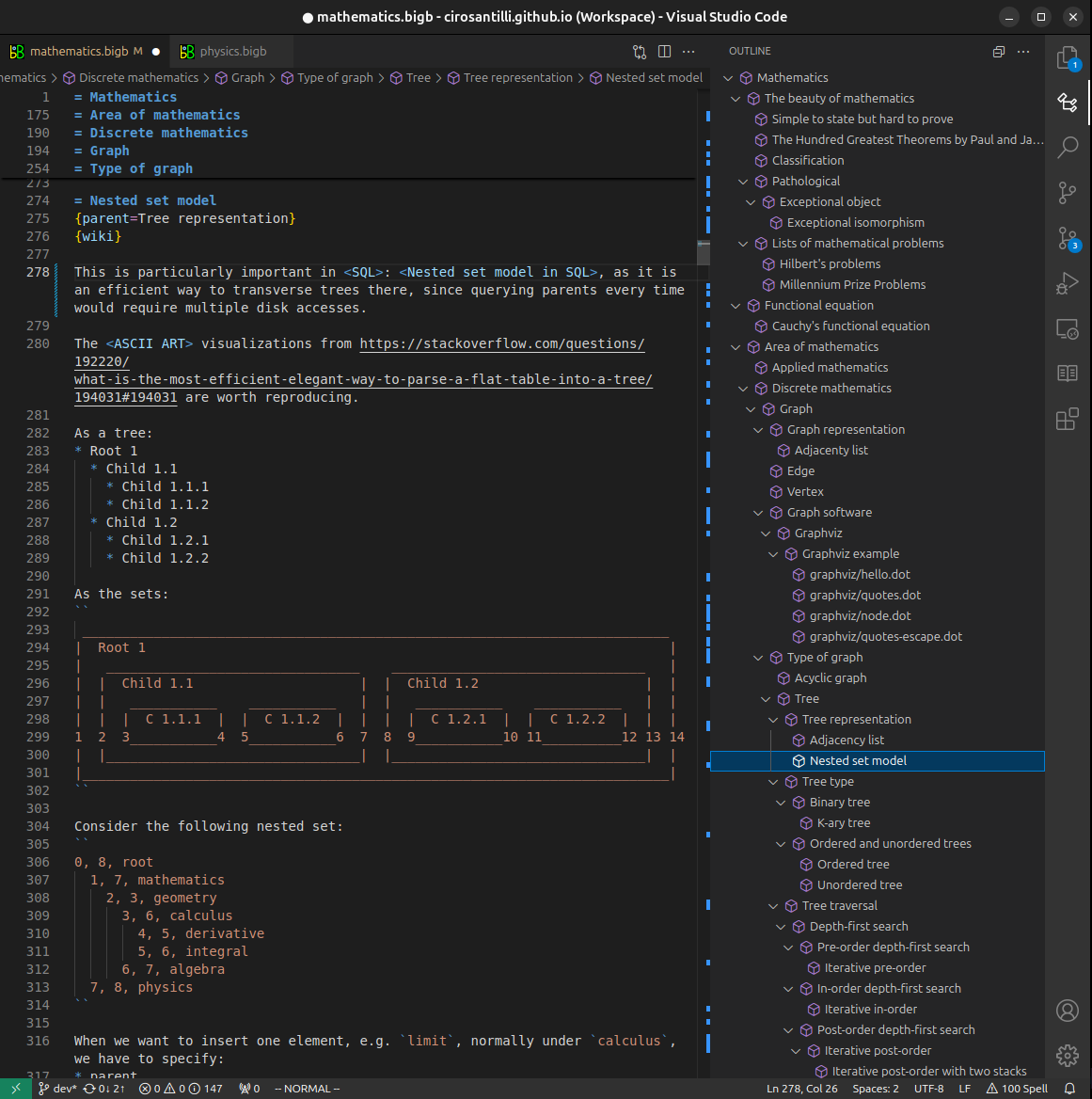

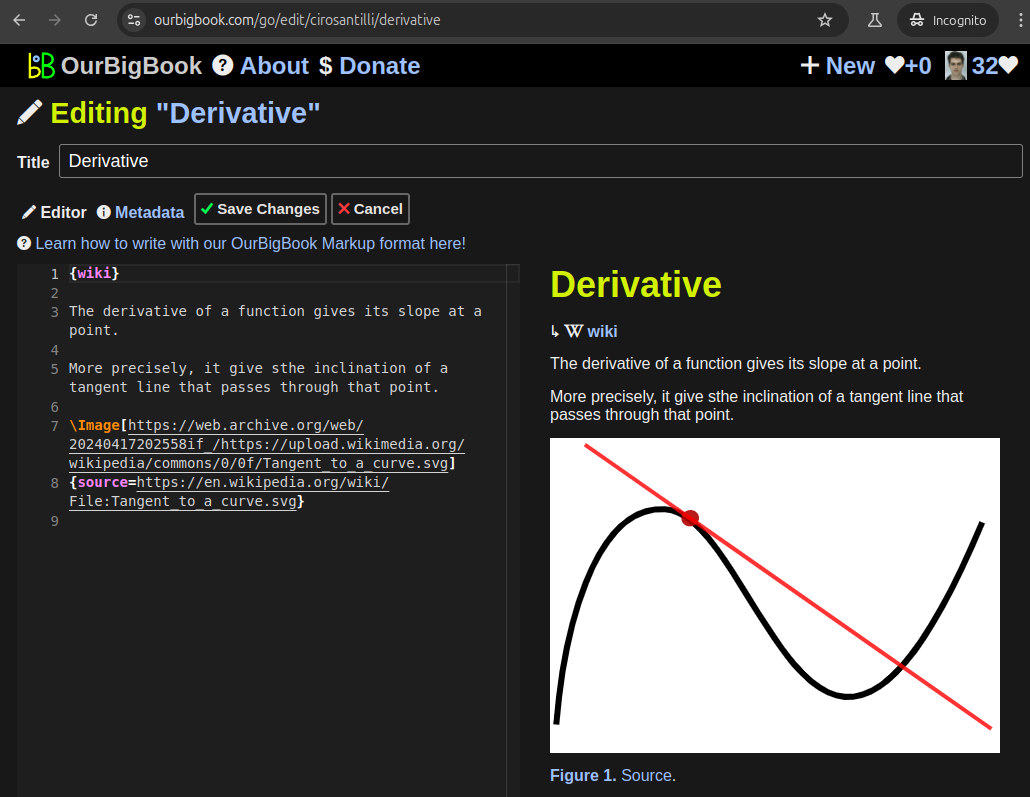

Figure 3. Visual Studio Code extension installation.Figure 4. Visual Studio Code extension tree navigation.Figure 5. Web editor. You can also edit articles on the Web editor without installing anything locally.Video 3. Edit locally and publish demo. Source. This shows editing OurBigBook Markup and publishing it using the Visual Studio Code extension.Video 4. OurBigBook Visual Studio Code extension editing and navigation demo. Source. - Infinitely deep tables of contents:

All our software is open source and hosted at: github.com/ourbigbook/ourbigbook

Further documentation can be found at: docs.ourbigbook.com

Feel free to reach our to us for any help or suggestions: docs.ourbigbook.com/#contact