The Ramer–Douglas–Peucker (RDP) algorithm, also known simply as the Douglas-Peucker algorithm, is a widely used technique in computational geometry for reducing the number of points in a curve that is approximated by a series of points. The primary purpose of this algorithm is to simplify the representation of a curve while preserving its overall shape and structure.

Sample and hold (S/H) is an electronic circuit commonly used in analog-to-digital conversion and signal processing. Its primary function is to capture and hold a voltage level from a continuous signal at a specific moment in time, allowing that value to be processed, sampled, or digitized. ### Key Functions of Sample and Hold: 1. **Sampling**: The circuit takes a sample of the input signal at a specific instant, typically triggered by a clock signal or another control signal.

A Successive-Approximation Analog-to-Digital Converter (SAR ADC) is a type of ADC that converts an analog signal into a digital signal through a process of successive approximation. It is widely used in applications requiring moderate speed and high resolution. The SAR ADC typically consists of a sample-and-hold circuit, a comparator, and a binary search algorithm implemented with a digital-to-analog converter (DAC).

XDAIS (Extended Data Interfaces for Signal Processing) algorithms refer to a set of standardized algorithms and their implementations designed for digital signal processing (DSP) on various platforms. They are part of the XDAIS interface specification developed by Texas Instruments (TI) to facilitate interoperability between software components in DSP systems. The main goal of XDAIS is to enable the seamless integration of different algorithms from various developers, allowing them to work together in a consistent framework.

The Visvalingam-Whyatt algorithm is a method for simplifying polygons and polyline geometries by reducing the number of vertices while preserving overall shape and important features. Developed by V. Visvalingam and J. Whyatt, the algorithm is particularly useful in the context of geographic information systems (GIS) and computer graphics.

Eight-dimensional space, often denoted as \(\mathbb{R}^8\) in mathematical contexts, is an extension of the familiar three-dimensional space we experience daily. In eight-dimensional space, each point is described by a set of eight coordinates.

The Chandrasekhar number, usually denoted as \( \mathcal{Ch} \), is a dimensionless quantity used in the field of fluid mechanics, particularly in the study of convection. It characterizes the stability of a fluid layer heated from below and contributes to the understanding of convection patterns in a fluid due to temperature differences.

Coordinate systems by dimensions refer to different ways of representing points in space according to the number of dimensions involved. Each dimension adds a degree of freedom or a direction in which you can move. Here are the most commonly used coordinate systems based on dimensions: ### 1D - One-Dimensional Space In one-dimensional space, points are represented along a single line. - **Coordinate System**: Typically, a number line is used where each point is represented by a single real number (x).

Dimension reduction is the process of reducing the number of features (or dimensions) in a dataset while retaining as much information as possible. This is particularly useful in machine learning and data analysis for several reasons: 1. **Simplifying Models**: Reducing the number of dimensions can lead to simpler models that are easier to interpret and require less computational power. 2. **Improving Performance**: It can help improve the performance of machine learning algorithms by reducing overfitting.

The concept of the "fourth dimension" in art refers to an aspect of representation that transcends the traditional three dimensions of height, width, and depth. In a broader sense, the fourth dimension is often associated with time, implying a dynamic or temporal element to an artwork, as well as the potential for movement or change within a static piece.

"Interdimensional" refers to concepts, phenomena, or entities that exist or operate across multiple dimensions. In various fields, the term can have different implications: 1. **Physics and Cosmology**: In theoretical physics, particularly in string theory and higher-dimensional models, "interdimensional" may refer to interactions or relationships between different spatial dimensions beyond the familiar three dimensions of space and one of time. Some theories propose additional dimensions in which certain fundamental forces or particles may interact.

The Euclidean plane is a two-dimensional geometric space that adheres to the principles of Euclidean geometry, named after the ancient Greek mathematician Euclid. It is characterized by several key features: 1. **Points and Lines**: The Euclidean plane consists of points, which have no dimensions, and straight lines, which extend infinitely in both directions, defined by two distinct points.

Extra dimensions refer to spatial dimensions beyond the conventional three dimensions of height, width, and depth that we experience in our everyday lives. The concept often arises in various branches of theoretical physics, particularly in string theory and some models of cosmology, where additional dimensions are proposed to explain certain physical phenomena or to unify fundamental forces. ### Key Concepts of Extra Dimensions: 1. **String Theory**: In string theory, fundamental particles are not point-like objects but rather tiny, vibrating strings.

As of my last knowledge update in October 2023, "FinVect" could refer to a few different things depending on the context, as it does not point to a widely recognized term or concept. It may relate to financial vector analysis, a financial technology company, or a specific tool or software used in finance and analytics.

The "Poppy-seed bagel theorem" is an informal conjecture associated with the field of topology in mathematics, and specifically, it relates to the stability and properties of certain shapes. It humorously suggests that a poppy-seed bagel (a toroidal shape) can be transformed into various other shapes (deformations) while maintaining some topological properties.

Dimensionless quantities are physical quantities that do not have any associated units of measurement. They are pure numbers, representing ratios or relationships that can be compared without the influence of a specific measurement system. Because they do not depend on any particular measurement unit, dimensionless quantities can be useful in various fields of science and engineering, allowing for easier comparison and analysis across different systems.

Dynamic similarity is a concept used in fluid mechanics to compare different flow situations. It occurs when two or more flow systems exhibit the same behavior under similar conditions, which can be characterized by dimensionless numbers. In particular, the Reynolds number and the Womersley number are two important dimensionless parameters used to analyze fluid flow in different contexts such as in biomedical applications (e.g., blood flow in arteries) and engineering (e.g., behavior of different types of fluids in pipes).

The heat release parameter (HRP) is a dimensionless quantity used in the study of combustion and fire dynamics to evaluate the potential for fire spread and the intensity of a fire. It is defined as the ratio of the energy released during a fire per unit area of the burning material to the mass or volume of that material. Essentially, it helps to quantify how much energy is being released from a fire relative to the amount of combustible material available.

The F-number, also known as the f-stop, is a numeric scale that represents the ratio of the focal length of a lens to the diameter of the aperture (the opening through which light enters the camera). It is a key factor in photography and optics that affects the exposure and depth of field of an image.

The Lockhart–Martinelli parameter (often denoted as \( X \)) is a dimensionless number used in the field of two-phase flow, particularly in the study of boiling and condensation processes. It is commonly applied in the analysis of pressure drop in pipelines carrying both liquid and vapor phases.

Pinned article: Introduction to the OurBigBook Project

Welcome to the OurBigBook Project! Our goal is to create the perfect publishing platform for STEM subjects, and get university-level students to write the best free STEM tutorials ever.

Everyone is welcome to create an account and play with the site: ourbigbook.com/go/register. We belive that students themselves can write amazing tutorials, but teachers are welcome too. You can write about anything you want, it doesn't have to be STEM or even educational. Silly test content is very welcome and you won't be penalized in any way. Just keep it legal!

Intro to OurBigBook

. Source. We have two killer features:

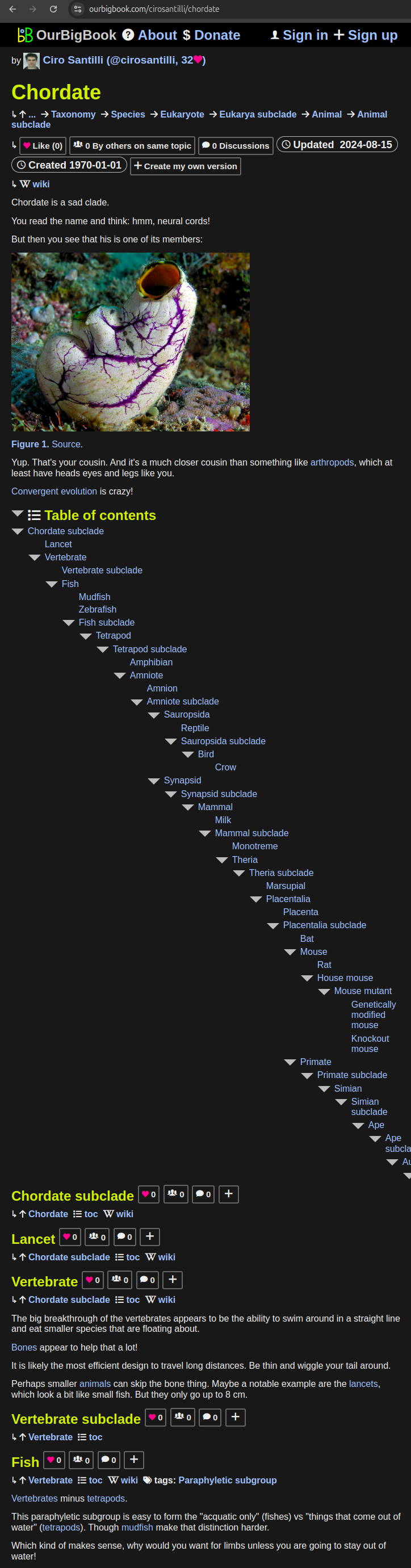

- topics: topics group articles by different users with the same title, e.g. here is the topic for the "Fundamental Theorem of Calculus" ourbigbook.com/go/topic/fundamental-theorem-of-calculusArticles of different users are sorted by upvote within each article page. This feature is a bit like:

- a Wikipedia where each user can have their own version of each article

- a Q&A website like Stack Overflow, where multiple people can give their views on a given topic, and the best ones are sorted by upvote. Except you don't need to wait for someone to ask first, and any topic goes, no matter how narrow or broad

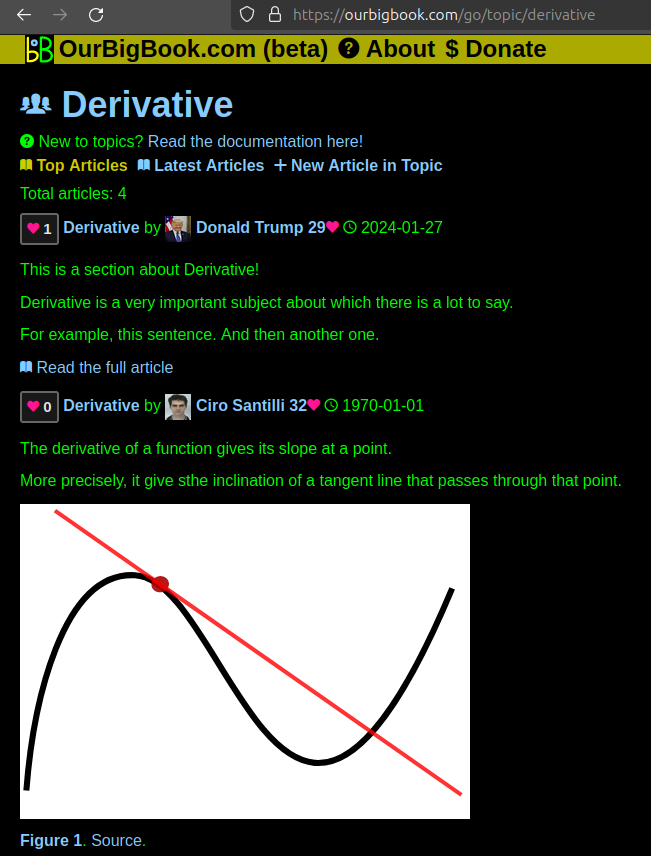

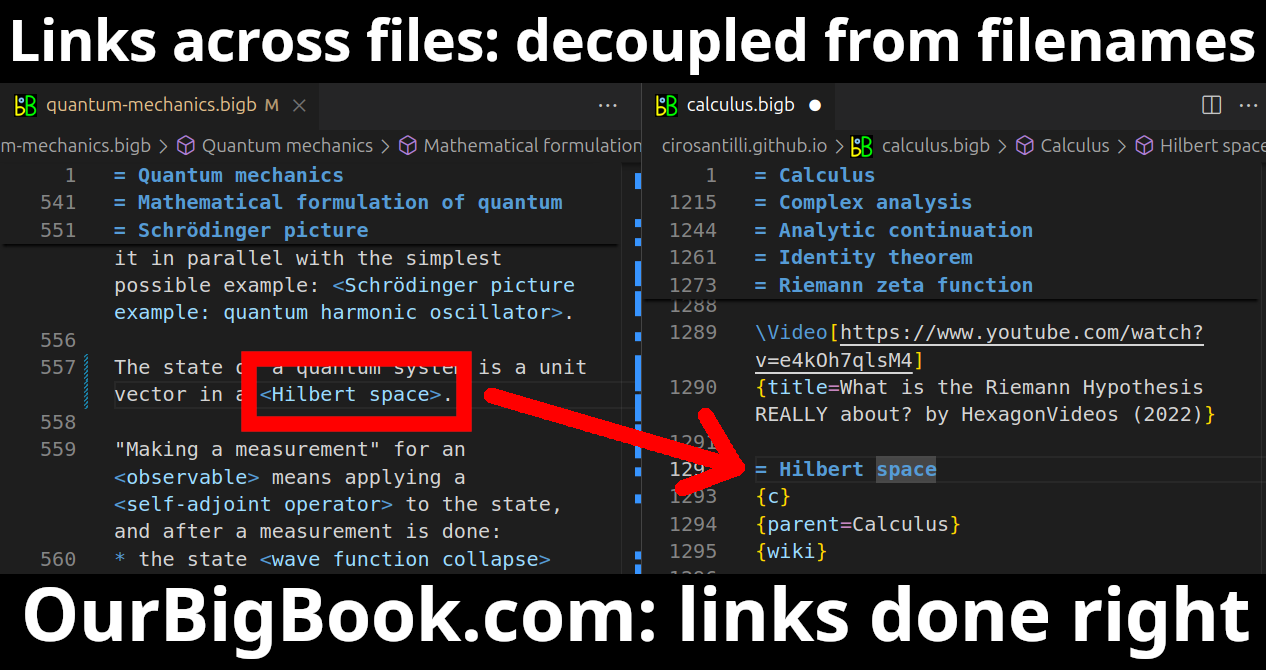

This feature makes it possible for readers to find better explanations of any topic created by other writers. And it allows writers to create an explanation in a place that readers might actually find it.Figure 1. Screenshot of the "Derivative" topic page. View it live at: ourbigbook.com/go/topic/derivativeVideo 2. OurBigBook Web topics demo. Source. - local editing: you can store all your personal knowledge base content locally in a plaintext markup format that can be edited locally and published either:This way you can be sure that even if OurBigBook.com were to go down one day (which we have no plans to do as it is quite cheap to host!), your content will still be perfectly readable as a static site.

- to OurBigBook.com to get awesome multi-user features like topics and likes

- as HTML files to a static website, which you can host yourself for free on many external providers like GitHub Pages, and remain in full control

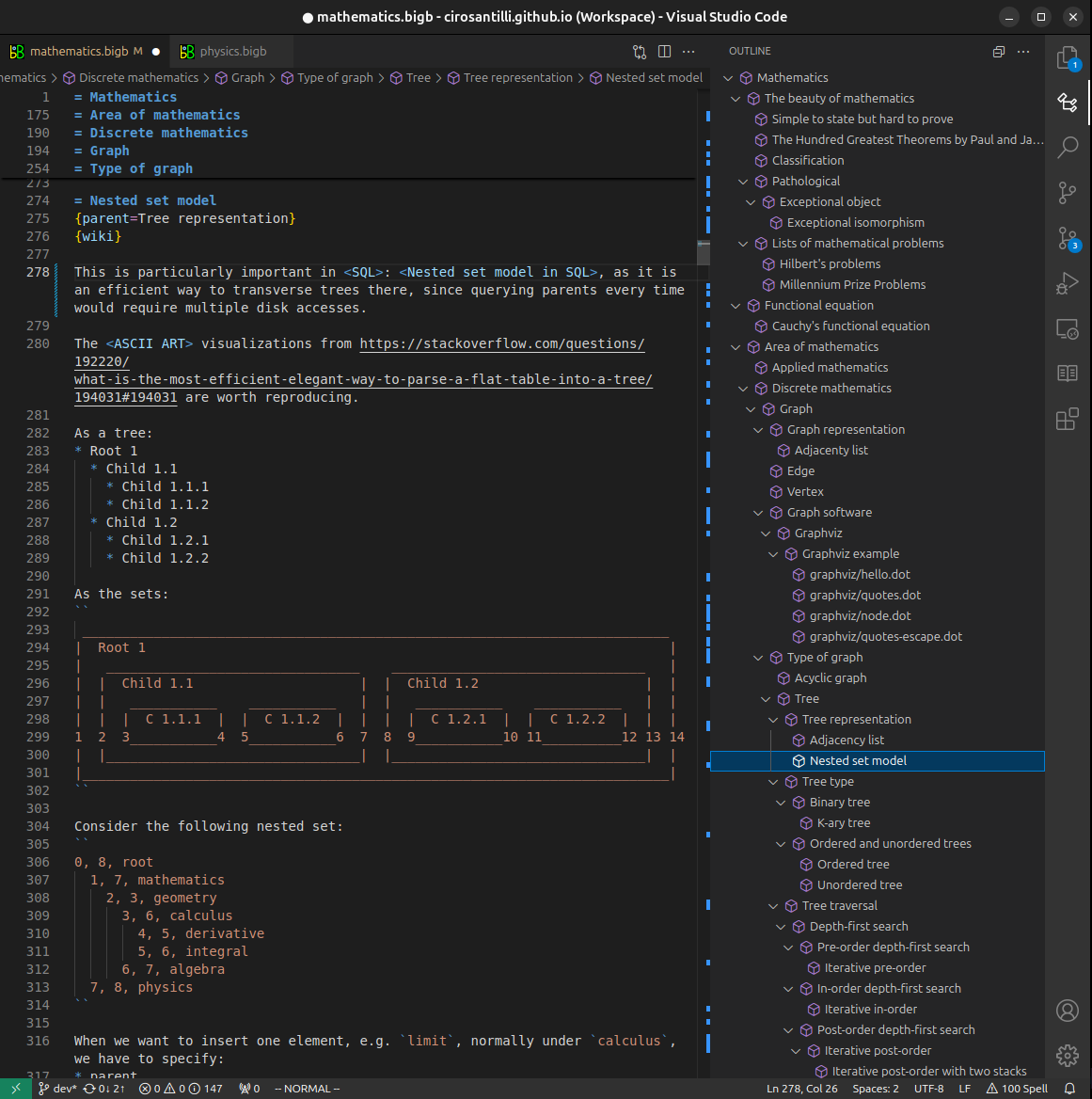

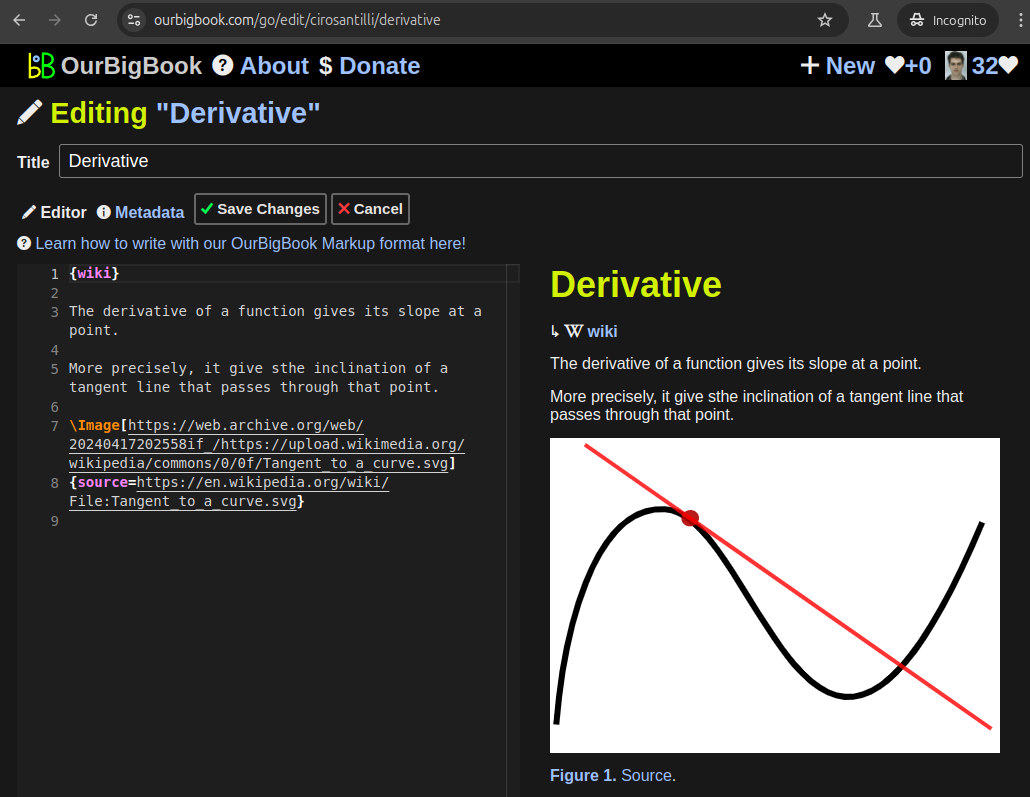

Figure 3. Visual Studio Code extension installation.Figure 4. Visual Studio Code extension tree navigation.Figure 5. Web editor. You can also edit articles on the Web editor without installing anything locally.Video 3. Edit locally and publish demo. Source. This shows editing OurBigBook Markup and publishing it using the Visual Studio Code extension.Video 4. OurBigBook Visual Studio Code extension editing and navigation demo. Source. - Infinitely deep tables of contents:

All our software is open source and hosted at: github.com/ourbigbook/ourbigbook

Further documentation can be found at: docs.ourbigbook.com

Feel free to reach our to us for any help or suggestions: docs.ourbigbook.com/#contact