"X-Ray Spectrometry" is a peer-reviewed scientific journal that focuses on the field of X-ray spectrometry, which involves the analysis and characterization of materials using X-ray techniques. The journal publishes original research articles, reviews, and technical notes that cover advancements in techniques, applications, and developments related to X-ray spectrometry. Topics may include but are not limited to X-ray fluorescence (XRF), X-ray diffraction (XRD), and other X-ray-based analytical methods.

A complexometric indicator is a type of chemical indicator used to detect the endpoint of a titration involving complex formation, particularly in complexometric titrations. These indicators undergo a change in color when they bind to a metal ion or when the metal ion is displaced from the indicator's complex, signaling that sufficient reagent has been added to the solution.

Quantum-optical spectroscopy is a field of study that combines concepts from quantum mechanics and optical spectroscopy to analyze the interaction of light with matter at the quantum level. This technique is used to investigate and understand the properties of materials by examining their response to light, particularly at the atomic and molecular scales. In quantum-optical spectroscopy, light is often described in terms of quantum mechanics, where it can be considered as both waves and particles (photons).

The term "hot band" can refer to different concepts depending on the context: 1. **Music**: In the music industry, a "hot band" typically refers to a musical group that is currently very popular or trending. These bands often receive a lot of media attention, sell out shows, and have a strong following. They could span various genres, including rock, pop, hip hop, and more.

X-ray standing waves (XSW) refer to a phenomenon that occurs when X-rays are diffracted from a crystal or a periodic structure in such a way that they create standing wave patterns. This effect can be understood through the principles of wave interference, where two waves of the same frequency traveling in opposite directions combine to form a stationary wave pattern.

Serpens South is a molecular cloud in the constellation of Serpens, which is notable for being one of the few regions in the sky where star formation is actively taking place. It is part of a larger structure known as the Serpens constellation complex, which is characterized by dense, cold regions of gas and dust where new stars are being born. The cloud is particularly interesting to astronomers because it hosts a number of young stellar objects and protostars, offering insights into the processes of star formation.

The Trifid Nebula, also known as M20, is a stunning and well-known region of star formation located in the constellation Sagittarius. It is approximately 5,200 light-years away from Earth. The Trifid Nebula is notable for its distinct features, which include a combination of an emission nebula, a reflection nebula, and a dark nebula.

A solar prominence is a large, bright feature extending outward from the Sun's surface, often in an arch-like shape. These structures are composed of cooler, dense gas (plasma) that is suspended in the Sun's outer atmosphere, or corona, by magnetic fields. Prominences typically form in regions of strong magnetic activity, such as sunspot areas, and can extend thousands of kilometers into space.

Spörer's law refers to a phenomenon observed in solar physics related to solar activity and sunspot cycles. Specifically, it describes the relationship between the latitude of sunspots and their appearance over the solar cycle. According to Spörer's law, sunspots tend to form at higher latitudes during the early phases of a solar cycle and progressively appear closer to the solar equator as the cycle progresses toward its maximum phase.

The weather in 2009 varied greatly around the world, with significant climate events influencing various regions. Here are some notable weather-related events and trends from that year: 1. **Global Temperature**: 2009 was one of the cooler years of the decade, with global average temperatures slightly below the long-term trend. 2. **El Niño**: Early in the year, the tail end of the El Niño phenomenon influenced weather patterns, leading to unusual conditions in several regions.

Amihan is a figure in Philippine mythology often associated with a bird, specifically a bird that is said to be a "great bird" or a "bird of the heavens." In various folklore, she is often depicted as a large, beautiful bird resembling a mythical creature similar to a hawk or a giant eagle. In certain legends, Amihan plays a significant role in creation myths. One popular story describes her as a messenger or a deity who helped in the creation of the world.

Djang'kawu, also known as Djangkawu or Djangkawa, is a figure in the mythology of the Yolŋu people of Arnhem Land in Northern Australia. In Yolŋu culture, Djang'kawu is often described as a creator ancestor and is associated with various aspects of the natural world and the land. Djang'kawu is typically depicted as a figure who emerged from the sea or water, bringing life and culture to the land.

Lists of extreme temperatures refer to records of the highest and lowest temperatures ever recorded in various locations around the world. These lists can be categorized by different criteria, such as: 1. **Highest Recorded Temperatures**: - This includes the highest air temperature recorded on Earth. The highest officially recorded temperature is 56.7°C (134°F) in Furnace Creek Ranch, Death Valley, California, USA, on July 10, 1913.

A "microburst" is a small-scale, intense downdraft of air that can cause severe weather conditions, particularly in thunderstorms. While there isn't a formal "list of microbursts," microbursts can be categorized or described based on specific occurrences, their characteristics, effects, and the contexts in which they have been studied or observed.

The Storm Prediction Center (SPC) categorizes severe weather risk levels on a scale from 1 to 5, with Level 1 (Marginal) being the lowest risk and Level 5 (High) being the highest. Each level can be associated with specific severe weather events, such as tornadoes, severe thunderstorms, and flash flooding.

A "derecho" is a widespread and long-lived windstorm associated with a band of rapidly moving showers or thunderstorms. Derechos can produce straight-line winds that exceed 58 mph and can cause significant damage, similar to that of tornadoes. A list of derecho events typically includes significant occurrences of derechos throughout history, often highlighting the date, location, and the impacts caused by the storm.

"Snow in Florida" typically refers to the rare phenomenon of snow falling in the state, which is noted for its warm climate and subtropical weather. Snowfall in Florida is extremely uncommon, with only a few recorded instances in history, primarily in the northern parts of the state. One famous occurrence was in January 1977, when snow fell in various locations in Florida, including Miami, which is almost unheard of.

The weather in 2021 was marked by a variety of significant events and trends around the world. Here are some key highlights: 1. **Extreme Heatwaves**: The summer of 2021 saw unprecedented heatwaves, particularly in the Pacific Northwest of the United States and Canada. Cities like Portland and Seattle experienced record-breaking temperatures.

As of my last knowledge update in October 2023, I cannot provide real-time weather information. However, I can inform you about significant weather events and patterns that were noted throughout 2023 up until that time. Throughout the year, the world experienced various weather phenomena, including: 1. **Heatwaves**: Many regions faced exceptionally high temperatures, with heatwaves impacting Europe, North America, and parts of Asia.

Weather extremes refer to unusual, severe, or unseasonal weather conditions that deviate significantly from the average patterns expected in a given area. These extremes can have various forms, including: 1. **Heatwaves**: Prolonged periods of excessively hot weather, often with high humidity. Heatwaves can lead to health risks, droughts, and wildfires.

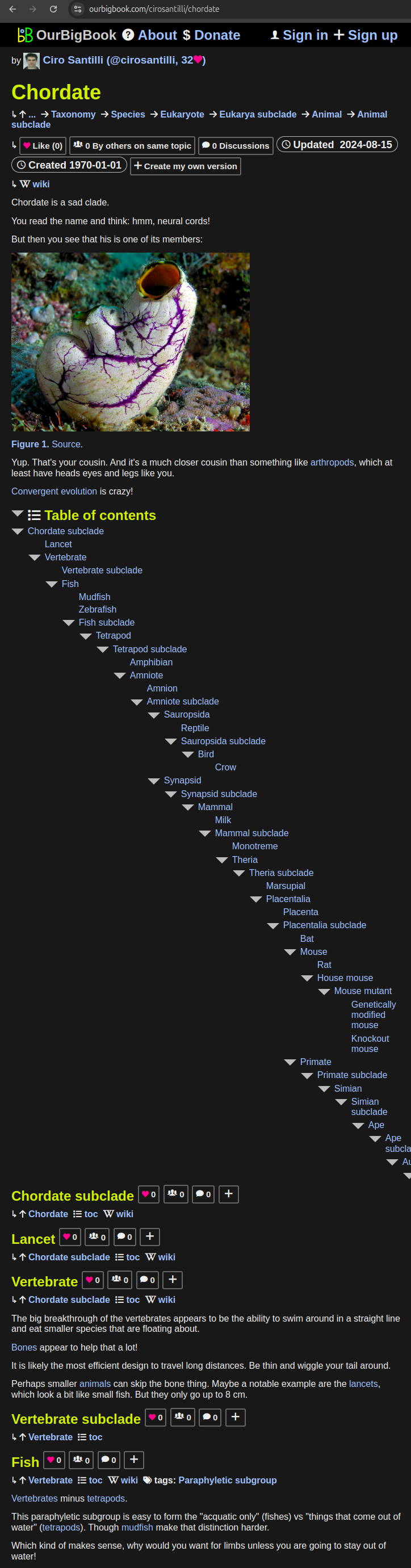

Pinned article: Introduction to the OurBigBook Project

Welcome to the OurBigBook Project! Our goal is to create the perfect publishing platform for STEM subjects, and get university-level students to write the best free STEM tutorials ever.

Everyone is welcome to create an account and play with the site: ourbigbook.com/go/register. We belive that students themselves can write amazing tutorials, but teachers are welcome too. You can write about anything you want, it doesn't have to be STEM or even educational. Silly test content is very welcome and you won't be penalized in any way. Just keep it legal!

Intro to OurBigBook

. Source. We have two killer features:

- topics: topics group articles by different users with the same title, e.g. here is the topic for the "Fundamental Theorem of Calculus" ourbigbook.com/go/topic/fundamental-theorem-of-calculusArticles of different users are sorted by upvote within each article page. This feature is a bit like:

- a Wikipedia where each user can have their own version of each article

- a Q&A website like Stack Overflow, where multiple people can give their views on a given topic, and the best ones are sorted by upvote. Except you don't need to wait for someone to ask first, and any topic goes, no matter how narrow or broad

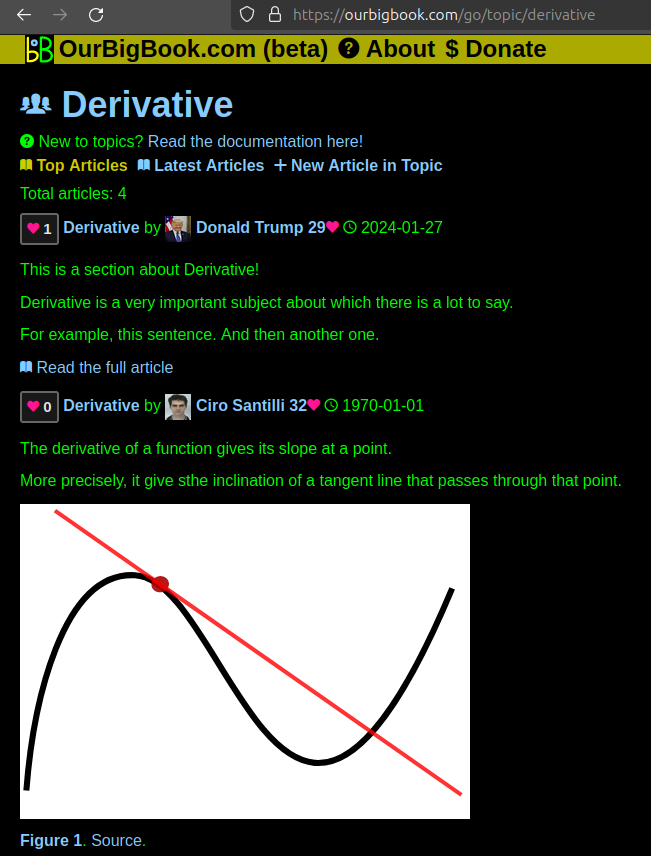

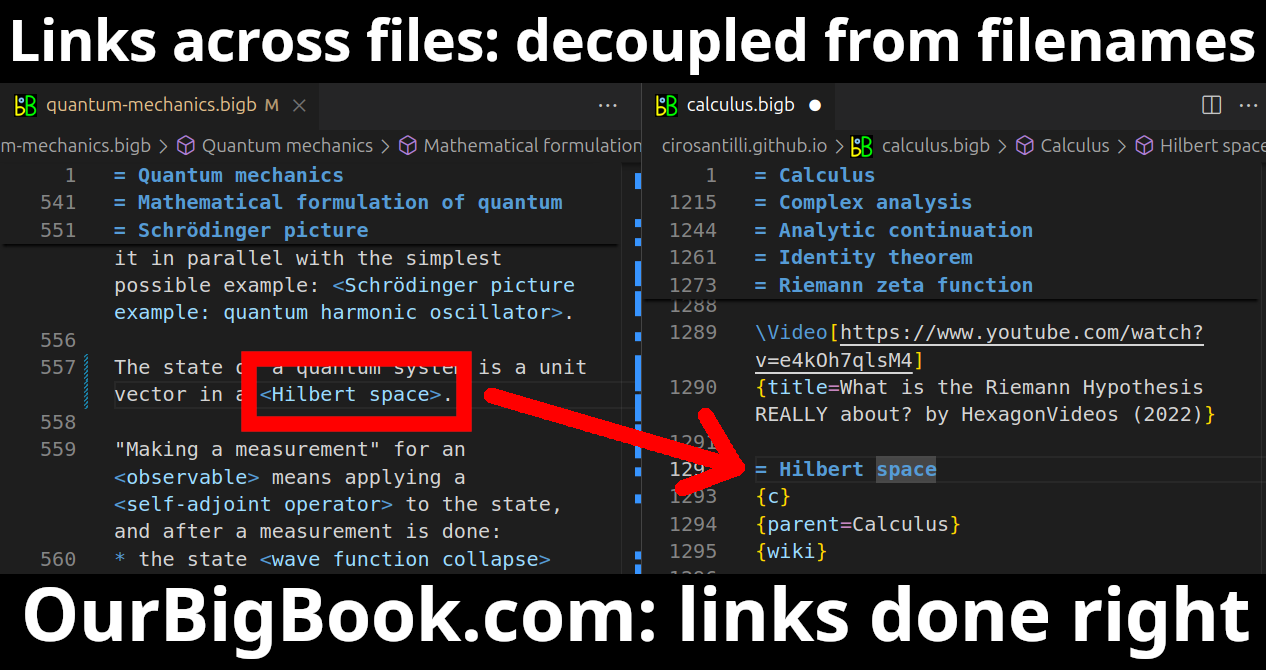

This feature makes it possible for readers to find better explanations of any topic created by other writers. And it allows writers to create an explanation in a place that readers might actually find it.Figure 1. Screenshot of the "Derivative" topic page. View it live at: ourbigbook.com/go/topic/derivativeVideo 2. OurBigBook Web topics demo. Source. - local editing: you can store all your personal knowledge base content locally in a plaintext markup format that can be edited locally and published either:This way you can be sure that even if OurBigBook.com were to go down one day (which we have no plans to do as it is quite cheap to host!), your content will still be perfectly readable as a static site.

- to OurBigBook.com to get awesome multi-user features like topics and likes

- as HTML files to a static website, which you can host yourself for free on many external providers like GitHub Pages, and remain in full control

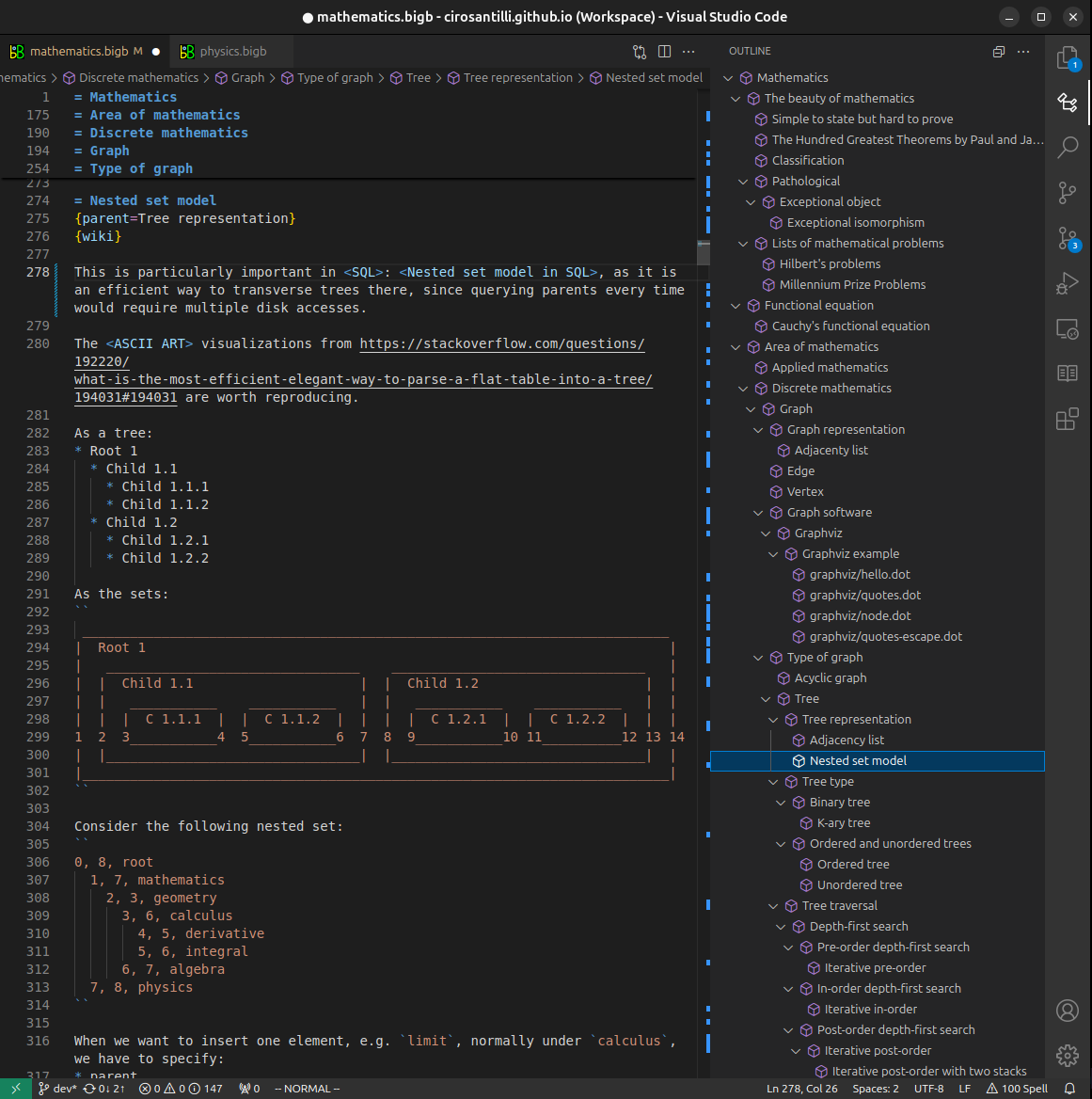

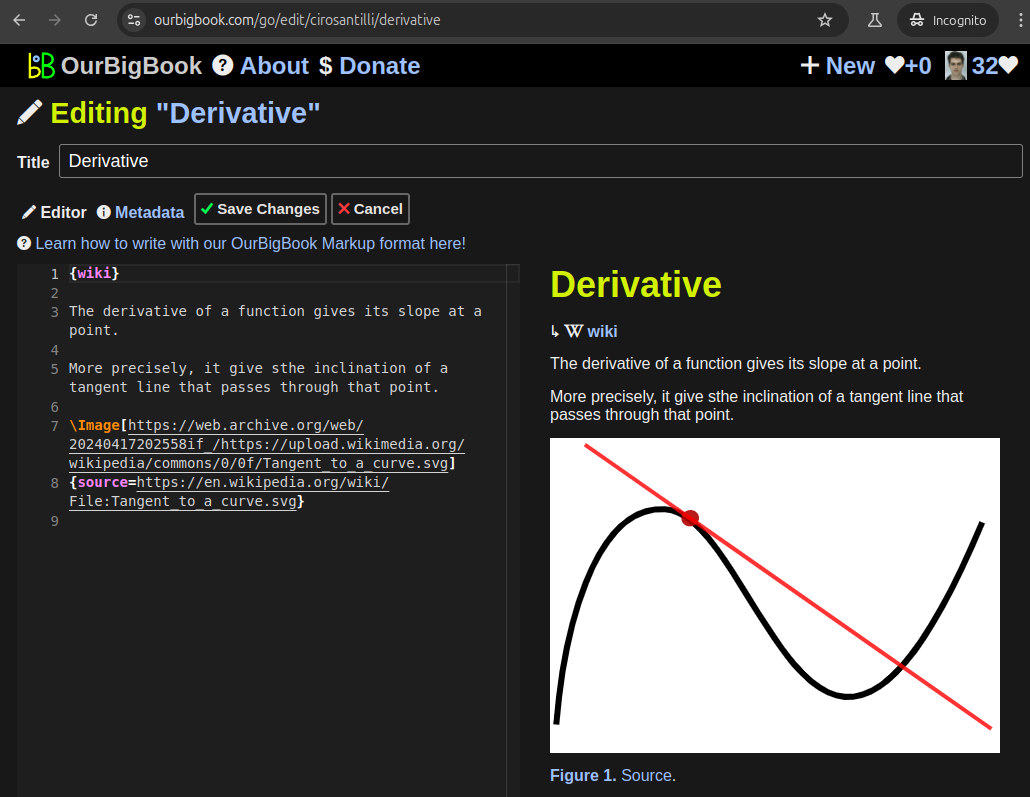

Figure 3. Visual Studio Code extension installation.Figure 4. Visual Studio Code extension tree navigation.Figure 5. Web editor. You can also edit articles on the Web editor without installing anything locally.Video 3. Edit locally and publish demo. Source. This shows editing OurBigBook Markup and publishing it using the Visual Studio Code extension.Video 4. OurBigBook Visual Studio Code extension editing and navigation demo. Source. - Infinitely deep tables of contents:

All our software is open source and hosted at: github.com/ourbigbook/ourbigbook

Further documentation can be found at: docs.ourbigbook.com

Feel free to reach our to us for any help or suggestions: docs.ourbigbook.com/#contact